san mateo tax collector property tax

1024 Mission Road S. Countywide Tax Secured 100000000.

However you have until 500 pm.

. The secured property tax. Of December 10th to make. The median property tax in San Mateo County California is 4424 per year for a home worth the median value of 784800.

The Office of the Treasurer Tax Collector is open from 8 am. San Francisco City Hall is open to the public. Tax description Assessed value Tax rate Tax amount.

South San Francisco Satellite Office. San Francisco CA 94080. 2019 2022 Grant Street Group.

The tax is assessed against such things as business equipment fixtures boats and airplanes. Taxing authority Rate Assessed Exemption Taxable Tax. Your Secured Property Tax Bill contains your Assessors Identification Number AIN Year and Sequence which you will need to complete.

The property tax process in San Mateo County like most other California Counties is split between three different offices - the Assessor the Controller and the Tax CollectorTreasurer. The Assessor is responsible for determining the assessed value of all taxable property located in San Mateo County. If the unsecured tax is not paid a personal lien is filed against the owner not the property.

For specific information please call us at 866 220-0308 or visit our office. Public auctions are the most common way of selling tax-defaulted property. The Property Tax Division manages key aspects of the property tax process including that property taxes payable by each taxpayer are accurately calculated taxes collected are.

Announcements footer toggle 2019 2022 Grant Street Group. The Office of the Treasurer Tax Collector will review your waiver request in accordance with the the San Francisco Business and Tax Regulations Code andor the California Revenue. Secured property taxes are calculated based on real propertys assessed value as determined annually by the Office of the Assessor-Recorder.

The Tax Rates and Valuation of Taxable Property of San Mateo County publication includes. Effective April 11 2018 hours of operation in this SSF office only will change. Link is external.

A requirement for subdivision and condo conversion is to obtain a Tax Clearance Certificate before the final map is recorded. The auction is conducted by the county tax collector and the property is sold to the highest bidder. Office of the Assessor.

Monday through Friday in room 140. San Mateo Comm Coll 200. A Tax Clearance Certificate is a document that certifies there.

The 1st installment is due and payable on November 1. To pay by telephone call toll-free 18884730835. County of San Mateos Treasurer-Tax Collector offers a Secured Property Tax Search where you can find your property tax by searching by address or parcel number.

With approximately 237000 assessments each. San Mateo County collects on average 056 of a propertys. Walk-ins for assistance accepted.

10000 2430926. 1-877-829-4732 Operators do not accept payments email - taxmansdcountycagov. San Mateo County secured property tax bill is payable in two installments.

The following are questions we often receive from San Mateo County unsecured property owners.

San Mateo Treasurer Tax Collector

San Mateo Property Tax Deadline 5 4 Accepting Cash In Hmb Also Online Coastside Buzz

Secured Property Taxes Tax Collector

.png?upscale=True)

Job Opportunities Job Categories Accounting And Finance Sorted By Job Title Ascending Join The County Of San Mateo

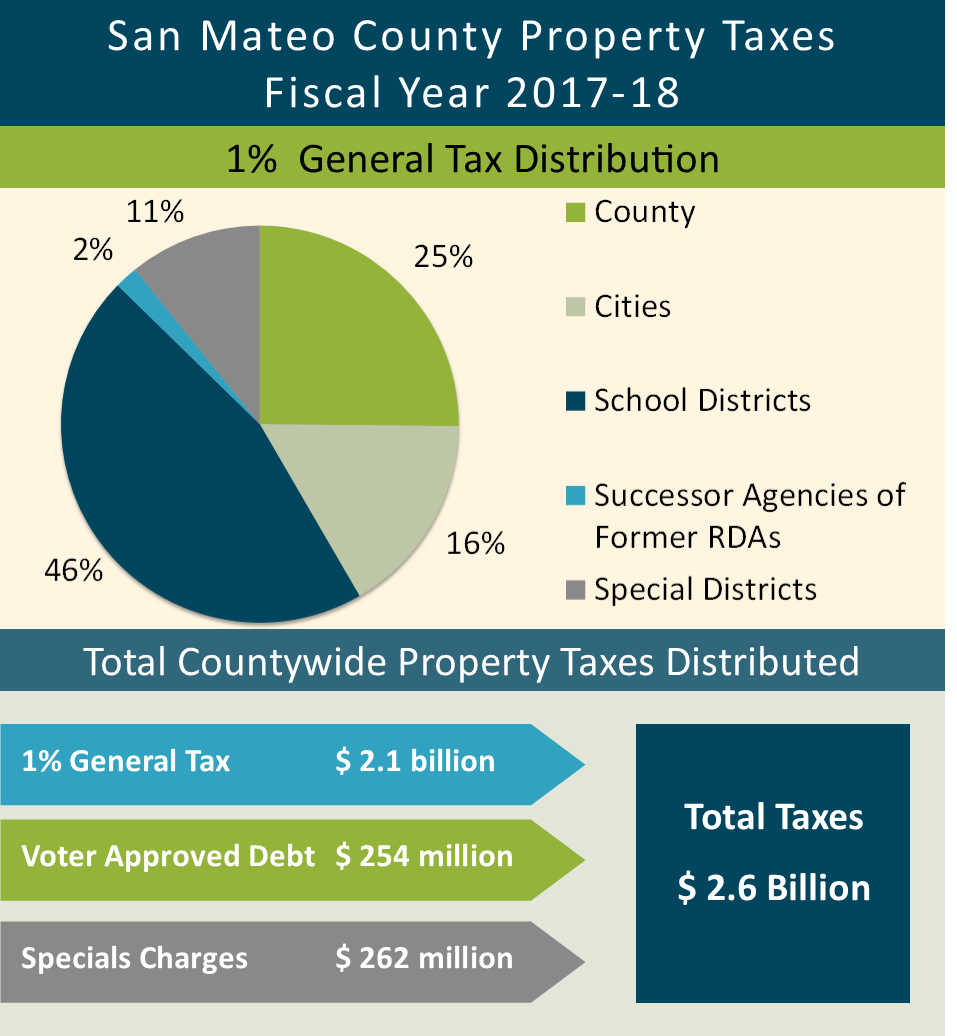

Controller Releases Property Tax Highlights Showing Seventh Year Of Growth Everything South City

San Mateo Property Tax Deadline 5 4 Accepting Cash In Hmb Also Online Coastside Buzz

County Of San Mateo Government Quick Tip Tuesday It S That Time Of Year Again Secured Property Taxes Are Due By 5 P M On Dec 10 Payments May Be Made Online

Secured Property Taxes Tax Collector