vermont income tax rate 2020

The tax schedules are designed so that Rate Schedule 3 provides an equilibrium. These income tax brackets and rates apply to Vermont taxable income earned January 1 2020 through December 31 2020.

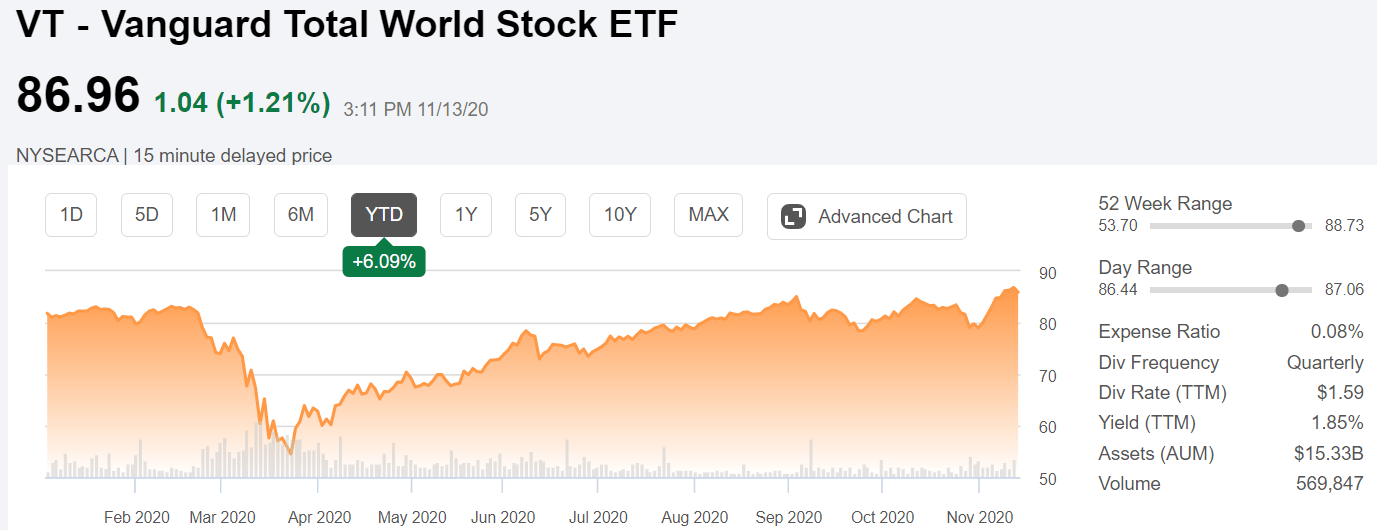

Vt If You Could Only Invest In One Etf For The Long Run Nysearca Vt Seeking Alpha

Find your income exemptions.

. The appropriate schedule is determined by a special formula in the Vermont Unemployment Compensation Law. Any income over 204000 and 248350 for SingleMarried Filing Jointly would be taxes at the rate of 875. 7380001 - 14885000.

2020 Vermont State Sales Tax Rates The list below details the localities in Vermont with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator. Pay Estimated Income Tax Online. IN-151 Application for Extension of Time to File Form In-111 Vermont Individual Income Tax Return.

Vermont Tax Adjustments and Nonrefundable Credits. Personal Income Tax - 2019 VT Rate Schedules. TaxTables-2020pdf 27684 KB File Format.

Tax Rate Filing Status Income Range Taxes Due 335 Single 0 to 40350 335 of Income MFS 0 to 33725. The Vermont Married Filing Jointly filing status tax brackets are shown in the table below. 2020 Vermont State Tax Tables.

2019 Vermont State Tax Tables. 2019 VT Rate Schedules. Tax Rates and Charts Mon 01112021 - 1200.

Vermonts income tax brackets were last changed two years prior to 2020 for tax year 2018 and the tax rates were previously changed in 2017. For the 2020 tax year the income tax in Vermont has a top rate of 875 which places it as one of the highest rates in the US. PA-1 Special Power of Attorney.

This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020. Calculator xlsx Underpayment of 2020 Estimated Individual Income Tax. CPA EXPLAINS 2021.

Payroll 2020 in Excel Vermont State Withholding Rates. Additionally taxpayers earning over 1M are subject to an additional surtax of 1 making the effective maximum tax rate 133 on income over 1 million. W-4VT Employees Withholding Allowance Certificate.

A wide range of clothing is exempt year round. How to Calculate 2022 Vermont State Income Tax by Using State Income Tax Table. 2020 Vermont Tax Deduction Amounts.

Check the 2022 Vermont state tax rate and the rules to calculate state income tax. 2021 Income Tax Withholding Instructions Tables and Charts. Find your gross income.

RateSched-2020pdf 11722 KB File. Income tax tables and other tax information is sourced from the Vermont Department of Taxes. Budget 2020 New Income Tax Rates New Income tax.

Income tax slab 2020-21 Pakistan Tax Rates for. Pay Estimated Income Tax Online. Find your pretax deductions including 401K flexible account contributions.

PA-1 Special Power of Attorney. Check the 2020 Vermont state tax rate and the rules to calculate state income tax. If you have questions you can contact the Franchise Tax Boards tax help line at 1-800-852-5711 or the automated tax service line at 1-800-338-0505.

Find your income exemptions. IN-111 Vermont Income Tax Return. Vermont State Personal Income Tax Rates and Thresholds in 2022.

Vermont Tax Brackets for Tax Year 2020 As you can see your Vermont income is taxed at different rates within the given tax brackets. 2022 Vermont state sales tax. Municipalities can add 1 to that but the average combined rate is 622 according to the Tax Foundation.

2020 VT Rate Schedules. How to Calculate 2020 Vermont State Income Tax by Using State Income Tax Table. Details of the personal income tax rates used in the 2022 Vermont State Calculator are published below the calculator.

Monday February 8 2021 - 1200. 2020 VT Tax Tables. State Sales Tax 6 state levy.

2020 Vermont State Sales Tax Rates The list below details the localities in Vermont with differing Sales Tax Rates. W-4VT Employees Withholding Allowance Certificate. This page has the latest Vermont brackets and tax rates plus a Vermont income tax calculator.

Find your pretax deductions including 401K flexible account contributions. Vermont also taxes estates that exceed 275 million in value. Pay Estimated Income Tax by Voucher.

Vermont collects a state corporate income tax at a maximum marginal tax rate of 8500 spread across three tax brackets. A financial advisor in Vermont can help you understand how taxes fit into your overall financial goals. The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022.

Find your gross income. There are a total of eleven states with higher marginal corporate income tax rates then Vermont. W-4VT Employees Withholding Allowance Certificate.

2022 Vermont Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614. Detailed Vermont state income tax rates and brackets are available on this page.

Vermonts 2022 income tax ranges from 335 to 875. Vermont Income Tax Return. Section 1326 of the Vermont Unemployment Compensation Law provides five different rate schedules each with twenty-one tax rates.

Pay Estimated Income Tax by Voucher. Tax Year 2020 Personal Income Tax - VT Rate Schedules. Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66 76 and 875 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses.

Exact tax amount may vary for different items. 2021 Tax Rates Just Released. Meanwhile total state and local sales taxes range from 6 to 7.

The tax is imposed at a flat 16 rate. 2020 Vermont Education Tax Rates Information Videos. Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66 76 and 875 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses.

Groceries clothing prescription drugs and non-prescription drugs are exempt from the Vermont sales tax. PA-1 Special Power of Attorney. 2020 VT Tax Tables.

Vermont School District Codes. IN-111 Vermont Income Tax Return. The Vermont Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Vermont State Income Tax Rates and Thresholds in 2022.

34 rows Vermont Credit for Income Tax Paid to Other State or Canadian Province. 2019 VT Tax Tables. Counties and cities can charge an additional local.

Special Offers Stoweflake Mountain Resort Spa Stowe Vermont Mountain Resort Romantic Things To Do Resort Spa

Filing A Vermont Income Tax Return Things To Know Credit Karma

Florida Minimum Wage Minimum Wage Previous Year How To Plan

Dentist Approved Advice On How To Care For A Tooth Filling Tooth Filling

Walmart Has Made A Genius Move To Beat Amazon Walmart Walmart Stock Walmart Cyber Monday

When And Where To File Your Tax Return In 2018 Tax Return Tax Paying Taxes

Vermont Income Tax Brackets 2020

Star Studded Line Up On Judging Panel Announced For Wirex And The Fintech Times Rising Women In Cr Fintech Forex Trading Tips Cryptocurrency Trading

State Corporate Income Tax Rates And Brackets Tax Foundation

2020 Minimum Wage Increases Affordable Bookkeeping Payroll Minimum Wage Wage Payroll

United States Population Density Kids Encyclopedia Children S Homework Help Kids Online Dictionary The Unit Map Rural Landscape

Half Of Vermont Towns Will See Increased Property Tax Rates Vtdigger

Vermont Sales Tax Small Business Guide Truic

Vermont Income Tax Calculator Smartasset

Vermont Income Tax Calculator Smartasset