estate tax changes in 2025

Making large gifts now wont harm estates after 2025 On November 26 2019 the IRS clarified. The estate tax is imposed on bequests at death as well as inter-vivos during life gifts.

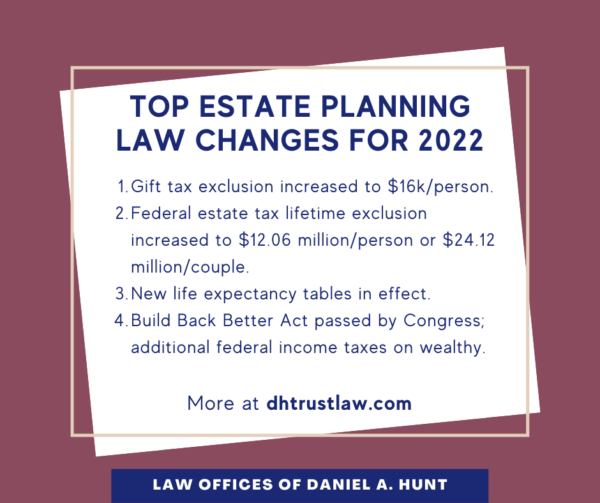

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

Couples can pass on 228 million.

. This increase in the estate tax exemption is set to sunset at the end of 2025 meaning the exemption will likely drop back to what it was prior to 2018. A separate annual gift exclusion for each donee is set at 15000 in 2021 The estate tax exemption was set at 5 million in 2011. WASHINGTON Today the IRS announced that individuals taking.

The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation. View 1 photos for 2025 Tyler St Union NJ 07083 a bed bath 0 Sq. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. As of 12252021 the estimated. The estate tax exclusion has increased to 1206 million.

Dont leave your 500K legacy to the government. See details for 25 Canterbury Ct 2025 Piscataway NJ 08854. If this occurs and his plans to reduce the exemption to 3500000 with an increased maximum tax rate of 45 are passed it could add an additional 1410000 in Estate.

This increase expires after 2025. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Get your free copy of The 15-Minute Financial Plan from Fisher Investments.

City of Jersey City PO. If they do nothing and live past 2025 they may have a taxable estate of 18 million 30 million less 12 million exemptions. In Person - The Tax Collectors office is open 830 am.

A certain amount of each estate 5. By Mail - Check or money order to. Single family home built in 1943 that sold on 12241992.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. Making large gifts now wont harm estates after 2025. Box 2025 Jersey City NJ 07303.

After that the exemption amount will drop back down to the prior laws 5 million cap. Ad Get free estate planning strategies. Investment property in PISCATAWAY NJ located at 25 CANTERBURY CT 2025.

Transfers certain estate tax costs and the exemption. Estate Tax Exclusion Changes Now and in 2025. The current estate and gift tax exemption is scheduled to end on the last day of 2025.

Visit the Estate and Gift Taxes page for more comprehensive estate and gift tax information. The higher levels expire in 2026 but individuals who make large gifts while the exemption is higher and die after it goes back down wont see. IR-2018-229 November 20 2018.

This is the amount one person can pass gift and estate tax free during their life or upon death. At a tax rate of 40 thats a 72 million tax bill. That could result in your estate.

The Tax Cuts and Jobs Act of 2017 increased the federal gift and estate tax basic exclusion amount BEA to 1158 million per individual or 2316 million per couple adjusted. Additionally in 10 years the gift and estate tax exemption will have likely reverted back to the lower 549 million amount for dates after 2025. This is the amount one person can pass gift and estate tax free.

With proper trust provisions a married couple could pass 2412 million. This property was purchased by HAIM ABRAHAM for 77500. View property data public records sales history and more.

When this tax act expires in 2025 the current 1206 million exemption which is inflation indexed and could be closer to 13 million at the end of 2025 falls to roughly 65.

How Could We Reform The Estate Tax Tax Policy Center

How Could We Reform The Estate Tax Tax Policy Center

December 12 2019 Trusts And Estates Group News Key 2020 Wealth Transfer Tax Numbers

How The Tcja Tax Law Affects Your Personal Finances

Corporation Tax Income Forecast Uk 2021 Statista

2020 Estate Planning Update Helsell Fetterman

Historical Estate Tax Exemption Amounts And Tax Rates 2022

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

This Article Has Been Superceded New State Budget Increases The Connecticut Estate Tax Exemption Cipparone Zaccaro

Gifting Time To Accelerate Plans Evercore

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How The Tcja Tax Law Affects Your Personal Finances

Historical Estate Tax Exemption Amounts And Tax Rates 2022

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Inheritance Tax Regimes A Comparison Public Sector Economics

:max_bytes(150000):strip_icc()/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)